In Germany, there is one way to get your medications: the Apotheke, which is simply the German word for pharmacy. Painkiller for headache is only available in the Apotheke. This is different in the US. Several over-the-counter (OTC) drugs can be purchased, for example, in supermarkets. Even some gas stations may sell OTC drugs.

The significant advantage of the German way is counseling with the pharmacist. It’s impossible to buy any medication without having at least a quick talk about treatment options and health conditions. Therefore, the customer is not left alone with a decision that may affect his or her well-being.

The US pharmacy advantage is in the simplicity of buying a drug that is classified as more or less harmless. Purchasing an Aspirin while running some weekly errands is a usual thing to do. This is possible, for example, in 3.600 of the 5.000 Walmart stores.

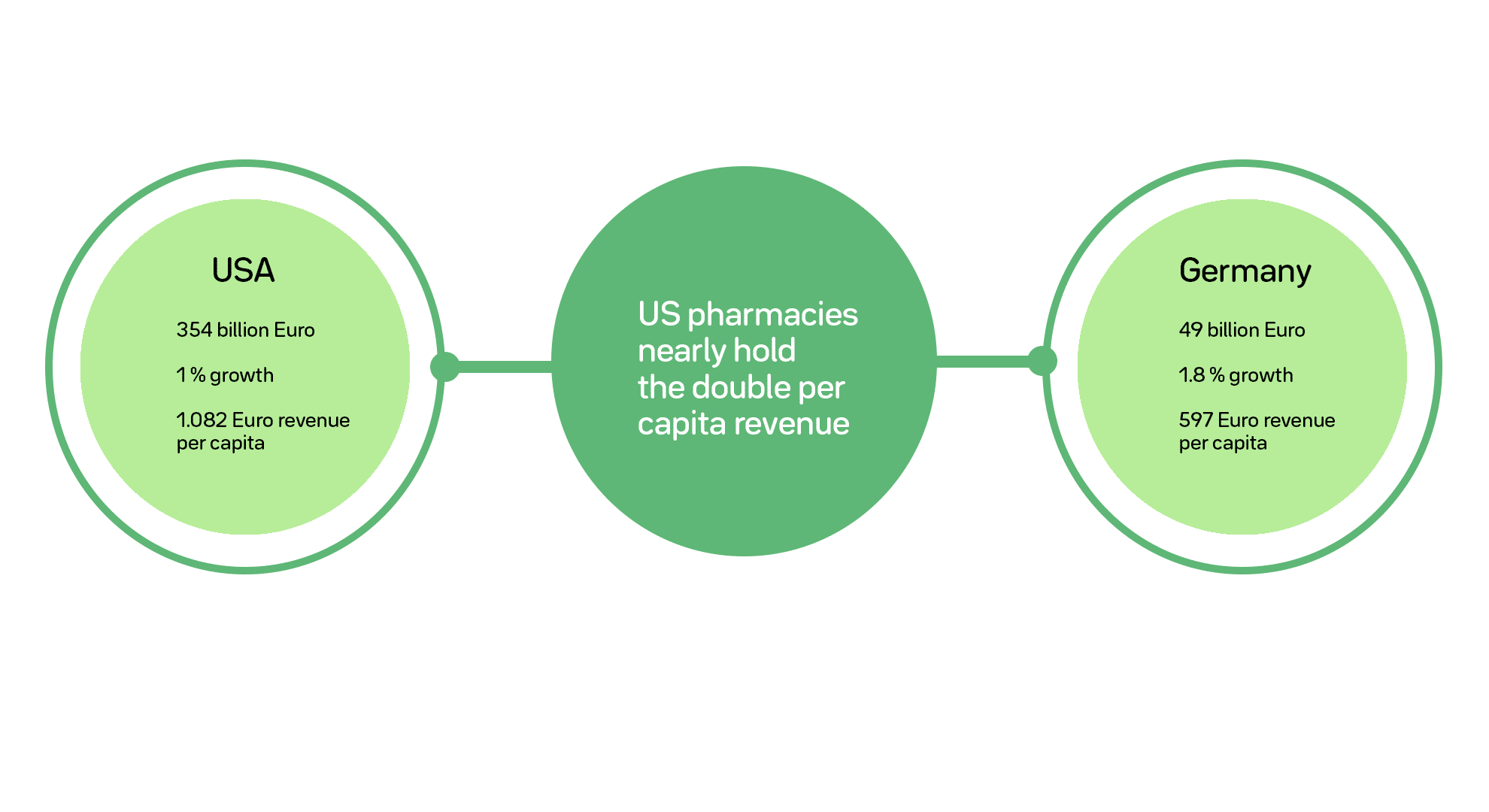

Per capita revenue of German and US pharmacies

Almost 20.000 Apotheken does the overall supply of drugs in Germany. That is a total of 24 pharmacies per 100.000 inhabitants. Compared to other countries in the EU it’s lower than average. The EU average is at 31 pharmacies per 100.000 inhabitants. A downside of the German Apotheken system is the opening hours. Especially in rural areas, the only pharmacy in town may be closed in the afternoon. Also, it’s not unusual to wait in line because everyone going to the Apotheke must talk to a pharmacist.

The way of handling prescription-only drugs (Rx) is similar in Germany and the US. Before buying a medicine, which is only available on prescription, it is necessary to show the prescription to the pharmacist first. Otherwise, the medication is not being handed over to the customer.

Nation-wide pharmacy corporations in the US

The German pharmacy law rules that a pharmacist is not allowed to own more than three branches next to his central pharmacy. This results in a large number of pharmacies that don’t belong to one company but several pharmacists. There is no bigger corporation or affiliated group in the pharmacy sector in Germany.

This structure is a sharp contrast to the US system. The biggest US pharmacy company is Walgreens. They own 8.000 pharmacies and have stores in every state. Besides drugs, they also sell contact lenses, a vast variety of beauty products and offer a photo print service.

About 23.000 independent pharmacies coexist next to 20.000 pharmacies owned by concerns. Besides, there are 9.000 supermarkets and 8.000 department stores which offer an included pharmacy.

The PBM as profitable middle man

Pricing for drugs in the US is done without any interference of the government. The prices of medications are self-regulated by the free-market economy.

One significant influence regarding prices and contracts in the pharmacy sector is Pharmacy Benefit Manager (PBM). PBM’s work is controversial.

They see their role as to

Reduce prescription drug costs and improve convenience and safety for consumers, employers, unions, and government programs.

On the other side, only three big players in the PBM sector (Express Scripts, CVS Caremark and Optum Rx) control 85 percent of the market. The whole PBM system seems to be opaque. How exactly prices for drugs are done and what it says in the contracts done by the PBM is a mystery.

More regulated pricing in Germany

The pricing for new drugs in Germany isn’t regulated. In the first year a new drug is released to the market, the pharma company decides about the price on its own. After the first year has passed, the pharma company and insurances start negotiating about the final price.

Pharmacies themselves are bound to the so-called “Arzneimittelpreisverordnung” which roughly translates as drug pricing regulation. This regulates the prices for drugs in pharmacies. All pharmacies are bound to have the same price for one drug. Pharmacies can’t have their deals with pharma companies.

Complex payment for German pharmacies

Each pharmacy gets a share of three percent of the price of a sold drug. Also, the Apotheke gets a flat charge of 8.35 Euro per sold unit of an Rx drug. The three percent is a reward for the pharmacies logistical task; the 8.35 Euro is the payment for the pharmaceutical service. At last, there is a flat charge of 0.16 Euro for each sold item to aid the pharmacies emergency service, which every Apotheke has to offer. This service includes opening hours at night time, Sundays or holidays. German pharmacies divide the emergency service within themselves in a round-robin system.